How I am using GreenBooks to budget for the next 6 months

This is a real life case study of how I am using GreenBooks to create a 6-month budget for myself.

The reason I created this budget is because I decided to devote all of my time on GreenBooks for at least six months. In order to do so, I have to stop doing software consulting work on the side.

This means I will have very limited amount of money coming in, so it’s very important that I know exactly how much I will spend (and make) to ensure I have enough money left over at the end of this period.

Although it’s not necessary to create a budget to use GreenBooks effectively (which makes it different from apps like YNAB), GreenBooks’ budget is both robust and requires minimum amount of work (again, unlike YNAB 🙂), as you will see in this article.

What is a budget

Put simply, a budget is a plan of how you want to spend your money. By creating a budget, you create a peace of mind knowing that you will be okay by the end of the budget period. It’s like a crystal ball that allows you to see into the future. You will know exactly how much you will save at the end of this period, as well as know how much you will have in all of your accounts at the end of the budget period.

A budget period in GreenBooks can be a month, a year, or any number of months. We designed it this way because we are all in different life situations at different points in time.

Annual budget

An annual budget is great if cashflow is not a problem for you, and you know you will always have enough money left in your bank accounts.

The reason an annual budget is great is because it requires the least amount of effort to create. You just create the budget once at the beginning of the year, and you know where you will stand by the end of the year. Of course, you need to adjust your budget along the way, but that is very small amount of maintenance work.

The other reason annual budget is great is because it takes into account expenses that don’t occur on a monthly basis, such as taxes, car insurance, memberships, and more. You are not creating a realistic budget if you don’t account for these non-monthly expenses, and an annual budget lets you capture those expenses.

Monthly budget

But, sometimes, you need to keep a tighter rein on your money. Perhaps you only have one paycheck coming in this month and you want to make sure you have enough money left in your bank account. This is when you would create a monthly budget.

A monthly budget is fine grained. As you will see, the budget in GreenBooks has a “today line” that shows you how much you should spend as of today. In a monthly budget, the today line moves a lot faster (since there are less days than a year), so you can immediately see the impact of your spending against the overall budget.

Arbitrary months budget

This is the example we will illustrate in this blog post. Because I am in a situation where I need to plan for the next six months, I created a six-month budget starting on a date of my choosing (9/13/2022). This is what’s great about GreenBooks’ budgeting system. A budget is just a “document”, you can create as many budgets as you want (i.e. as many plans as you want), and keep track of them independently. The flexibility of being able to specify the number of months means you can account for different life situations.

Let’s get started

To create a budget, simply click the ubiquitous + button on the lower left corner of the window, and select New Budget.

In the dialog that shows up, give the budget a name (e.g. Six-Month Budget), specify the number of months (in this case 6 months), and the start date of this budget (9/13/2022).

As soon as you click Create, GreenBooks will auto-generate a budget for you. The estimates generated for you are based on your last 12 months’ average.

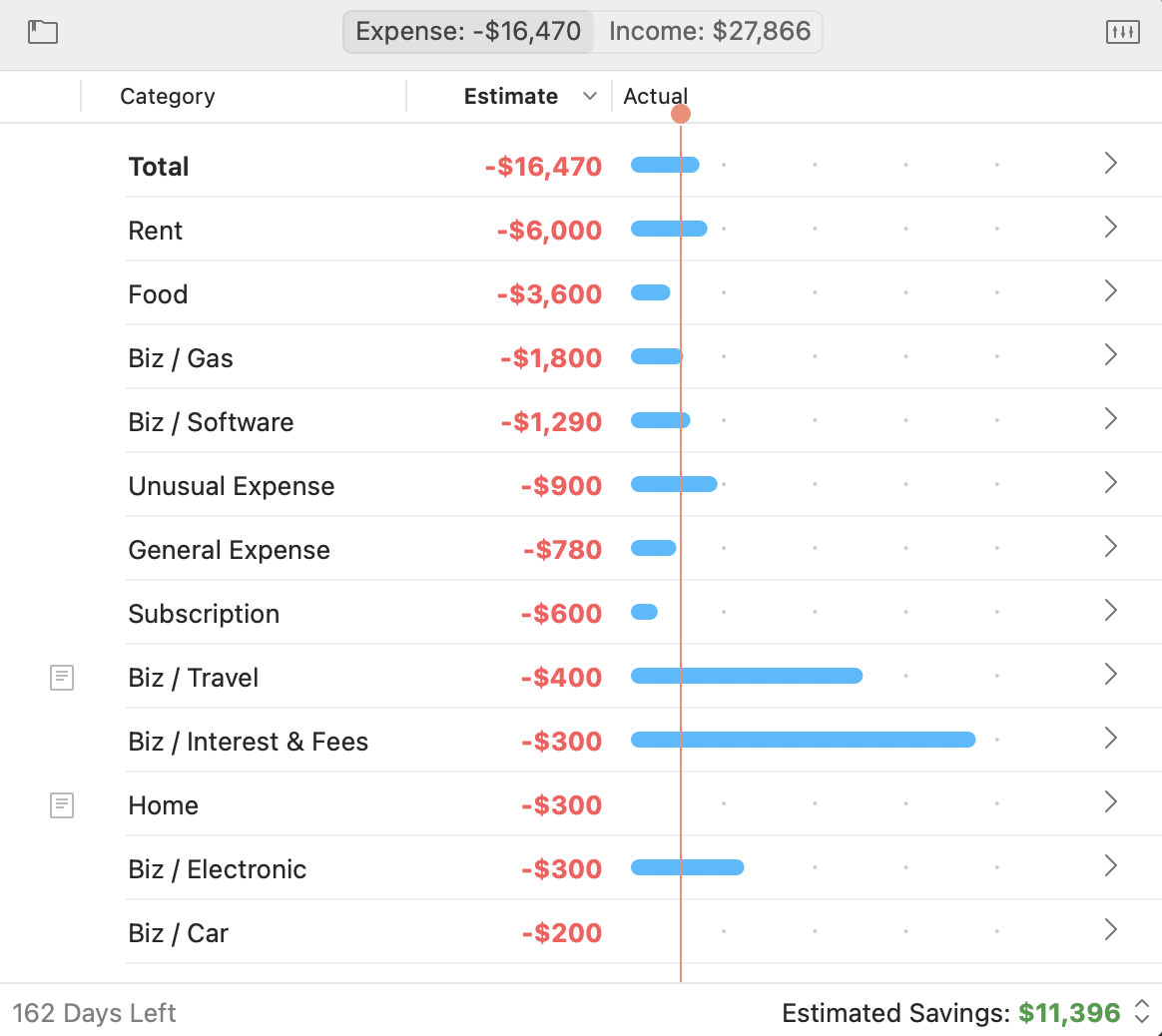

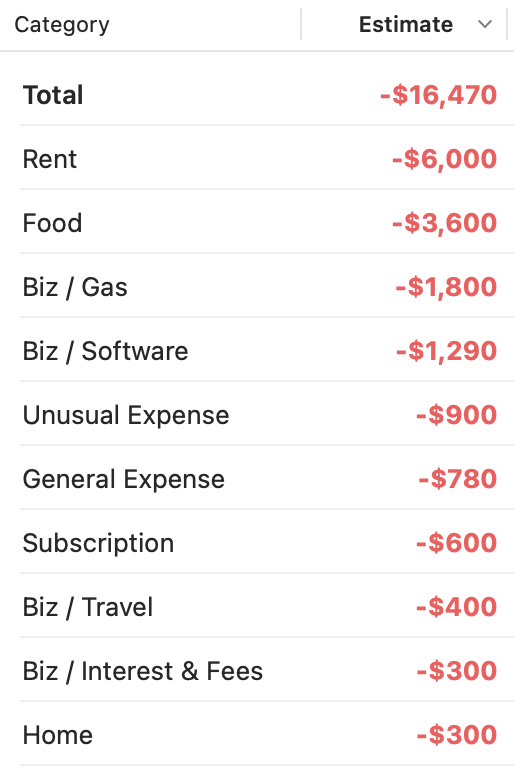

The generated budget has three columns:

- Category: The category that you want to set a budget for.

- Estimate: How much you plan to spend in this category during the budget period.

- Actual: How much you’ve actually spent.

Also on top, you can see there are two tabs:

- Expense: How much you plan to spend in total.

- Income: How much you expect to make in total.

Finally, on the lower right corner, you see Estimated Savings, which is a summary of how much money you will save (or lose) at the end of of this budget period. And if you click that text, you will also see what your ending balance will be if you follow through on this plan.

Simple design, powerful concepts

This simple design actually makes GreenBooks’ budget very effective and powerful.

First, let’s think for a moment what a budget is from a high level.

Think of a budget like a scale you want to balance. On the left side of the scale, you have your expenses. On the right side, your income. The goal is either to make the scale balance (expenses equals income), or better yet, have income be greater than expenses so you save some money.

To ensure you are living within your means, you want to create an estimate of what your total income is going to be, and compare that against your total expenses.

That is what the Expense and Income tabs are in GreenBooks’ budget. In those tabs, you see the total expenses and income you expect in this period.

So where do these totals come from? They are a sum of all the estimates for your expense and income categories.

It is important to set an estimate for all of your expenses and incomes. If you don’t do that, you are not creating an accurate budget. You need to account for everything.

That’s exactly what the left side of the budget view is:

To change the estimate for a category, just click the estimate’s label:

But it’s not enough to just create a budget. You need to be able to follow it. And that’s what the right side of the budget view is (the Actual column):

In the Actual column, the blue bars show you how much you have spend as of today. You can hover your mouse over the bar to see the exact amount, or click it to see the exact transactions:

And notice there is a vertical red line in the Actual column. That is what we call the Today Line. It shows you where your spending (and income) should be as of today. So, let’s say it’s half way through the month in a monthly budget, that line will be exactly at the middle.

The Today Line is what keeps you on pace each day to ensure you meet your budget goal. If your actual spending (blue bar) exceeds the Today Line, you know you are spending too fast and need to slow down.

These are all of the concepts you need to know to understand GreenBooks’ budgeting system.

Let’s look at my six months budget

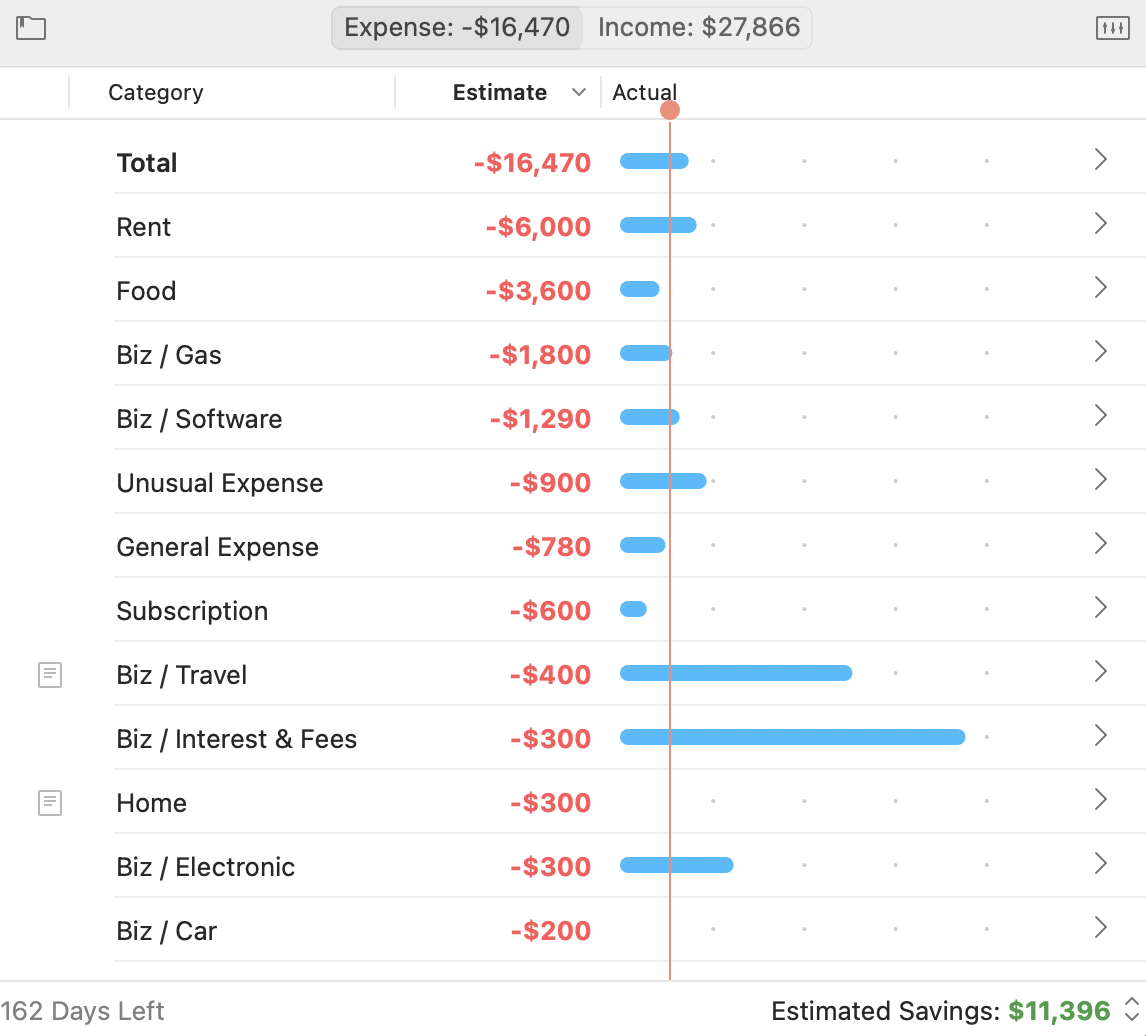

So, let’s take a brief look at my six months budget. Here are my expenses:

Here are some points to note:

- Rent is my highest expense category. My rent is $1000/month, so $6000 total.

- Food is usually the second highest category for people. Most people don’t realize that. My food budget is $600/month (much higher than before due to inflation). It’s very important that I stay within my Food budget, and as you can see in the blue bar for Food, I am behind the Today Line, which means I’m doing well. By monitoring this category everyday in the budget, I am motivated to save money on food.

- I like to really simplify my categories (i.e. not have too many), so I have two categories to help me do that. Unusual Expense captures all the big purchases in a month that is out of the ordinary and General Expense is a catchall for all of the miscellaneous expenses of the month. These categories help me reduce the number of categories I have to manage.

- Categories that begin with “Biz /“ are my business expenses. GreenBooks is great for solo entrepreneurs or freelancers who want to manage their business finances alongside their personal finances. I have been doing this for years.

- Notice some categories has a “note icon” to the left of the category name, such as “Biz / Travel”. When you set an estimate for a category, you can leave some notes to remind you how you arrived at the estimate.

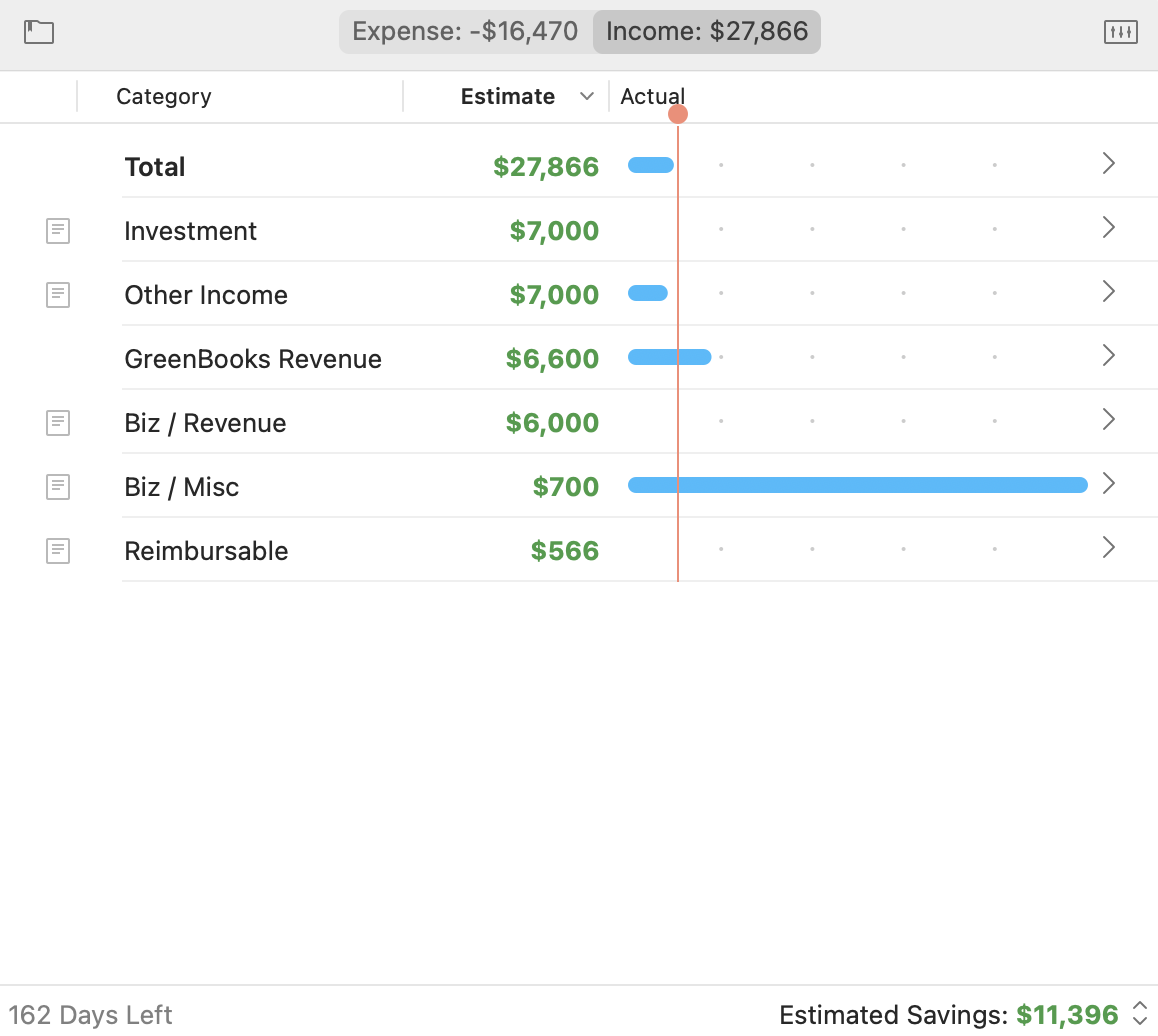

And here are my incomes, where I list all the incomes that will come in during this period:

As you can see in the bottom right part of the window, I expect to save $11,396 during this period, and if I click the Estimated Savings label, I can see my ending balance is $9,195.

My ending balance is $9,195 by design. When I created this budget, I worked backwards from my goal. My goal is to have in my accounts money that is three times of my monthly expenses ($3,000) as emergency cash. That is the commonly recommended amount by financial planners. So, started from that goal in mind, I played with the estimates of my expenses (lower my expenses) and also thought hard about where my money can come from (increase my income) to meet that goal.

For example, in order to reach that goal, I need to come up with $7,000 more than I already had coming in. That is why my “Other Income” category has an estimate of $7,000 in my Income tab. I simply set that as a goal, and I need to figure out how to make that money from any side job I do during this time. This is why you create a budget. You set a goal of what you want to achieve, and then figure out how to achieve them. A budget changes your behavior. Without a budget, you are just going blindly.

Conclusion

GreenBooks distinguishes itself from many other budget-focused app by not requiring you to create a budget. However, if your money is tight or you have specific goals you want to reach, GreenBooks’ budget is very effective and requires low maintenance.

When using GreenBooks, you can create a budget for a month, a year, or any number of months. A budget is simply a document that compares the sum of your expenses and incomes, to ensure you spend less than you make. You can create multiple budgets, even ones that run in parallel to each other.

Once you create a budget, you can forget about money for the rest of the month, year, or period. It brings you a peace of mind. Isn’t that what a personal finance app is all about?

Have comments? Email the author