Lesson 3: Keep your accounts up to date

Your Breakdown chart, budget and other insights inside GreenBooks are only as accurate as your transaction data. This is why it’s essential to keep your account data accurate.

The process by which you keep your accounts and transactions data accurate is called reconciliation. Reconciliation is the process by which you make your transactions data match your bank’s.

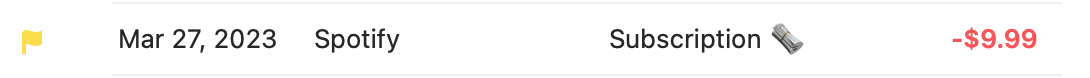

As you were entering transactions in GreenBooks, you may wonder what those yellow flags on the left mean.

The yellow flags indicate the transactions you entered are pending, because you haven’t verified yet that they have appeared on your bank’s side. During reconciliation, you clear those pending transactions that have appeared on your bank, bring in any transaction you forgot to enter, and as a result have your record match your bank’s exactly.

Well, it’s much easier if we show you how this is done in a video, so here it is.

Let’s be honest, reconciliation is the most difficult part of using GreenBooks, but once you do it a few times, it will be a breeze. It’s something you want to do once or twice a week. After you get into a habit of doing it, it can be an activity that brings you peace of mind, because you know you are truly on top of your accounts.

☝️ Summary

In this lesson you learned how to ensure your account information agrees with your bank’s through reconciliation. Your Breakdown chart is only as accurate as the data you have, so it’s essential to reconcile your accounts.

The recommended way to keep your accounts up to date is:

- Enter transactions manually as you spend money. This way, your Breakdown will always have the latest data.

- Once a week, import transactions from your bank into GreenBooks, to clear your pending transactions and bring in any transaction you forgot to enter.

If you do this regularly, keeping your accounts up to date is quite effortless.