Lesson 4: Other bookkeeping tips

In this lesson, we are going to quickly go over all of the remaining skills you need to properly manage transactions in GreenBooks. All of these are simple to understand.

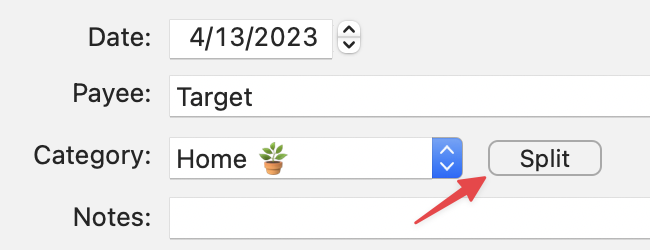

Split transaction

From time to time, you go to a store and spend money in multiple categories. Since you want your Breakdown chart to accurately reflect how much you spend in each category, you will want to split the transaction’s amount among multiple categories. To do so, simply click the Split button next to the category field.

Transfer money between accounts

On a reguarly basis, you are going to be transferring money between accounts. For example

- Transfer money from your checking to savings account

- Make a credit card payment

- Withdraw cash from your checking account and putting it in your wallet

All of these are considered transfers. Basically, anytime there is movement of money from one account to another, it is a transfer and you want to record it as such in GreenBooks. This video shows you how.

Edit multiple transactions at once

Sometimes, you want to make change to a large number of transactions at once. For example, you want to assign many transactions into a different category, or rename the payee of transactions to clean up your transactions list. The batch edit function of GreenBooks is designed to do exactly that.

A word about categories

An essential part of using GreenBooks effectively is to define the right set of categories for your transactions. With GreenBooks, you can define categories personalized to your needs.

One common mistake with categories is to define too many of them. As a rule of thumb, you should define as few categories as possible in order to get into a good insight into your spending in Breakdown and Budget. Having too many categories just makes GreenBooks harder to manage and doesn’t really bring you value in terms of gaining insight.

Keep in mind, you can always re-categorize down the road. For example with batch edit, you can easily partition transactions into more fine-grain categores in the future.

We recommend that you start with less than ten categories to start with.

One trick to minimize the number of categories is to have catch-all categories that lump miscellaneous transactions. For example, here are good categories to have:

- Untracked. For any transaction that doesn’t belong to any category.

- General Expense. For transactions such as cleaning supplies, personal care products, parking fees. There is no need to define a category just for these miscellaenous transactions.

- Unusual Expense. We all have large expenses that occur unexpectedly. Rather than creating a category for these, just have a category to lump them together.

Having a few number of categories will make it much easier to create your budget too, as you will see in a later lesson.

Oh, and GreenBooks lets you assign emojis to your categories! It’s a small thing you can do to make money management more fun 🙂.

☝️ Summary

In this lesson you learned all the tips and tricks you need to manage transactions in your accounts. In the next lesson, we are going to visit another way you can gain insight in GreenBooks (step 2 of the GreenBooks Method), and that is with the Trends chart.