BudgetmacOS

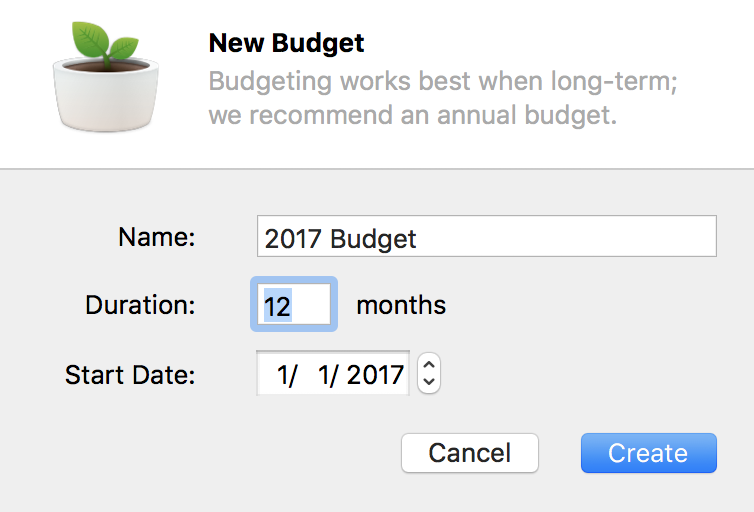

A budget is a plan of how you want to spend your money. To create a budget, select File > New Budget from the menu. You will be presented with the following form.

It’s best that you create a budget for an entire year (12 months), because some expenses don’t occur on a monthly basis. By budgeting for the whole year, you are essentially setting aside money for those items ahead of time.

When you click “Create”, GreenBooks will automatically generate a budget for you.

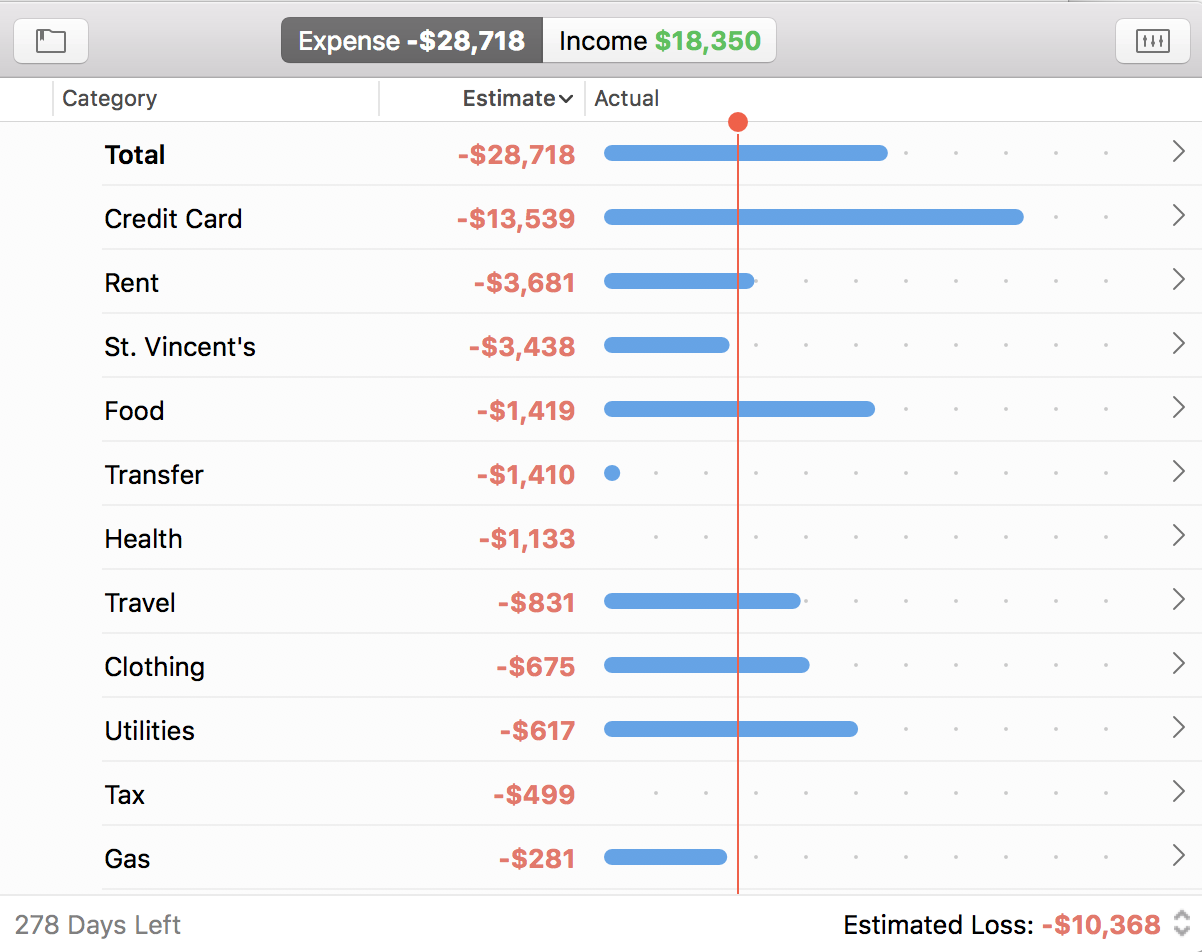

For now, let’s focus on the Category and Estimate column on the left.

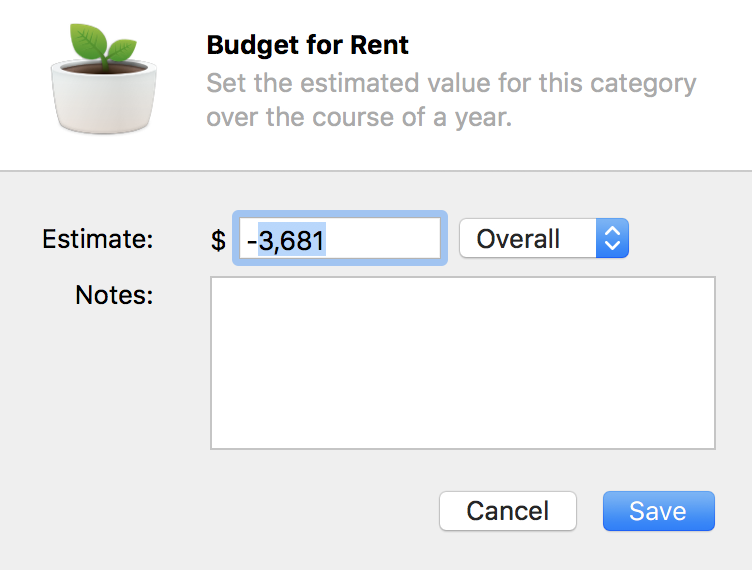

As you can see, estimates for all categories are generates for you based on your past spending habit. You can adjust the estimate for each category by clicking on the estimate label.

You can either set an overall amount for the entire year, or a monthly amount.

Once you are done setting estimate for Expenses, head over to Income and make sure you set all the estimates there too.

Once you’re done budgetting…

After you have set an estimate for all your categories, you will have a total estimate for the expense and income for the entire year. From that, you will know how much you will save or lose by the end of the year.

Think about that a little bit, this is the power of budgetting. At the beginning of the year, you already know how your financial picture will look by the end of the year.

Staying on track

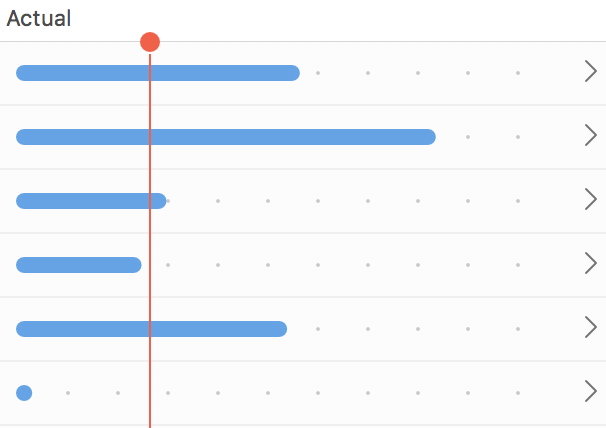

Of course, a budget is only a plan of how you will spend your money. Just as important as setting a budget is staying on track throughout the year. The progress bars in the Actual column on the right shows you the actual amount you spend in each category. The red line shows you where your progress should be as of today. If you are spending too fast, you know immediately and can adjust the budget as the year goes along.

This demonstrates the power and convenience of setting an annual budget. You just tweak it throughout the year. There is no need to create a new budget after each month.

Staying honest

Note that our budget takes into account all categories. This is staying honest, because if we only budget for some categories, then any category un-budgeted is essentially not accounted for. By having our budget encompass all categories, we get a full picture of how much we are spending, earning, and saving each year.