Getting Started

This is a fifty-thousand foot view of GreenBooks.

To manage your money effectively, you need to first pull all your accounts into one place, log your transactions and categorize each transaction.

Once you have all your transactions categorized, you can use the Breakdown feature in GreenBooks to see where your money is going.

Then, and this is an optional step, is you want to create a budget to keep your spending under control.

This is what we call the Three Simple Steps of GreenBooks.

Step 1: Keep Track of Your Accounts and Transactions

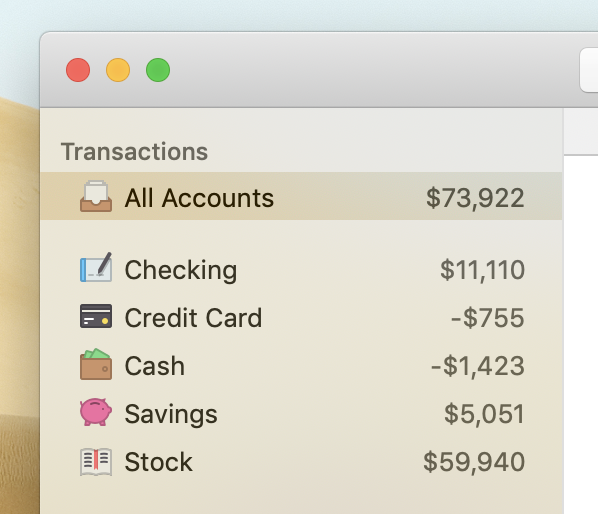

The first thing you are asked to do when you open up GreenBooks is to add your accounts.

Add all of the accounts you wish to track: checking, credit card, cash, even asset class such as stock portfolio.

Once you have all your accounts in one place, it’s time to begin logging your everyday transactions in them.

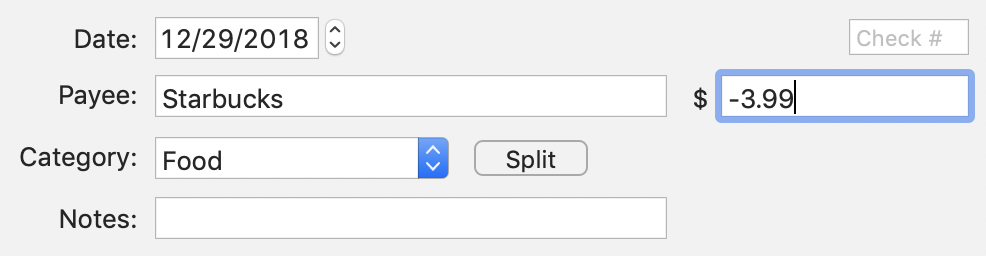

When you spend money on something, create a transaction. When you create a transaction, be sure to assign it a category. Category is what allows you to analyze your spending later.

Similarly, let’s say your paycheck comes in, log it as a deposit.

If you are keeping track of an asset class such as stock account, just add a transaction each month to adjust its value.

Step 2: Understand Your Money

GreenBooks has two types of chart that let you understand your spending and cashflow.

Breakdown Chart

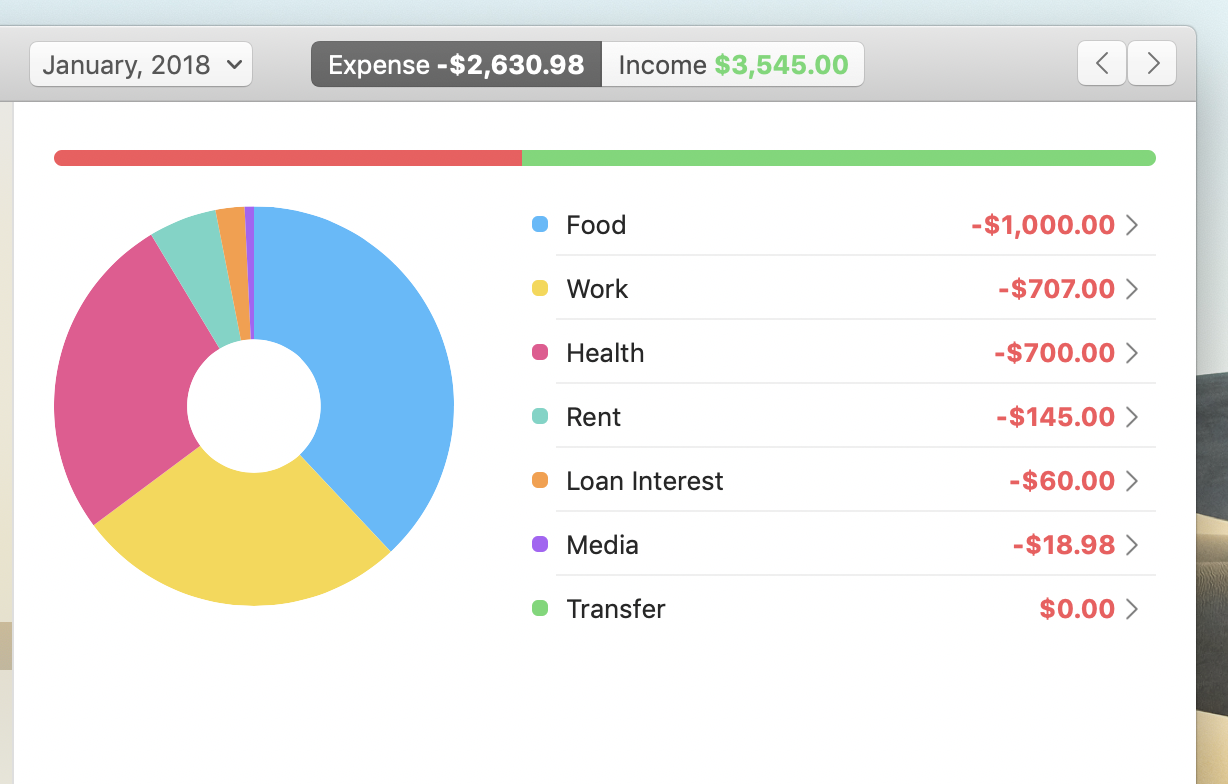

When you receive your monthly bank statement, have you ever wondered why you spent so much money? That’s what the Breakdown chart is for.

When you open Breakdown, it shows you all of your monthly expenses broken down by category.

You can drill into each category to see transactions that make up that category. Similarly, you can see how your income breaksdown as well. Click the date selector to choose a different time period.

With Breakdown, you know exactly where your money is going.

Trends Chart

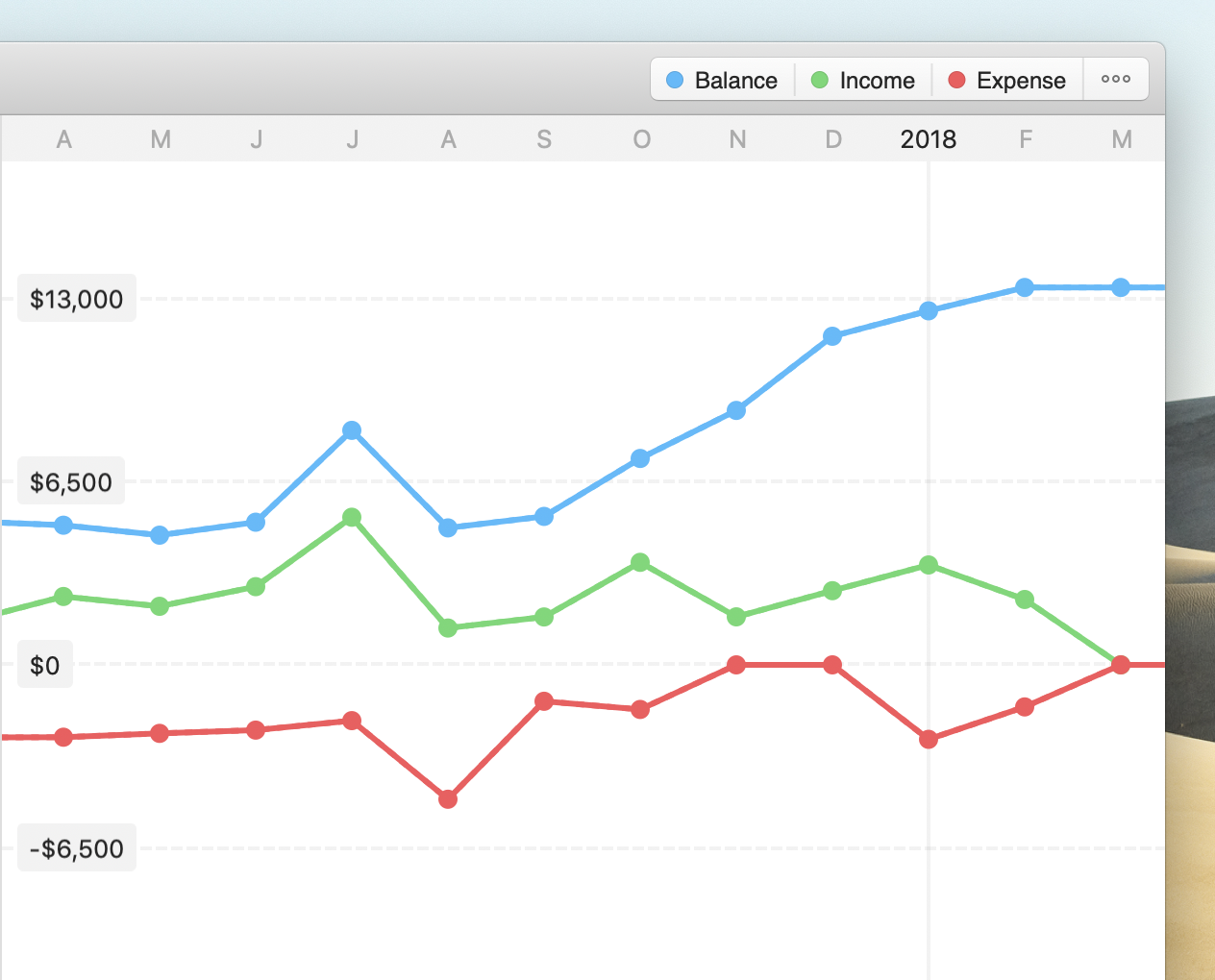

Trends let you see trends in your money.

- Balance Trend. See whether you are getting richer or poorer each month.

- Income & Expense Trend. Make sure you are spending less than you earn.

- Category Trends. See up and down in each of your categories over time.

As you can see, you can select multiple trends to see them side by side.

Step 3: Create a Budget

A budget is a plan of how you want to spend your money. GreenBooks doesn’t require that you create a budget. Many users find the Breakdown and Trends chart give them enough guidance on their spending. But when you have tighter finances, it’s a good idea to create a budget to ensure you will have enough left at the end of a period.

GreenBooks has a very flexible budgeting system. You can learn more about it in the Budgets section of this guide.